Chapter 6: Economy, Enterprise and Retail

6.1 Context

This Plan is being prepared in the context of a global pandemic that has created economic challenges for employment, incomes and businesses and brought unprecedented changes in the ways of work and living. Galway City has not been exempt from these experiences. The impact has left a legacy particularly in the hospitality and retail sector and the allied tourism trade. This was balanced by other elements of the City’s economy in particular the med tech, ICT and health care. It was also tempered by the relatively high level of public service employment in the City which rapidly transferred to an online service delivery model where employment levels and salaries remained stable. In general the economic prospects for Ireland as it edges out of the pandemic are optimistic notwithstanding the economic risks of Brexit, international tax reform measures and possible inflationary pressures both nationally and internationally.

It is anticipated that Galway City will mirror the national economic growth forecasted. The city has achieved economic success based on a high education attainment rate amongst the labour force, a supply of a young workforce, supplemented by inward migration, the development of key sector clusters, a low corporate taxation regime, a stable pro-business political environment and an attractive living environment and quality of life. However given that the Gross Value Added (GVA) per person in the region at €29,260 is less than halve the national figure of €67,639 there is still a need for a focused economic strategy to sustain and expand the role of the city as a regional NPF city and driver of economic growth within the MASP and wider Northern and Western Region if the objective of achieving a balanced economy and society as per the NPF is to be realised.

Galway City, being the main urban centre in this region will be a key economic and service support to enable the regional targeted 2040 population growth of 160,000-180,000 and to accommodate the significant proportion of the allied targeted 115,000 increase in regional jobs. The promotion and nurturing of the city’s economic and employment base is a priority in the plan in order to sustain the city and the wider region and to support the ambition for the economic role of Galway as an NPF regional city and strong contributor to national growth.

This economic growth will require efficient investment choices, a flexible and responsive labour force skills development system, and the development of a more sustainable and diversified enterprise sector that includes outward looking indigenous firms. Such a strategy for the city will also include for a culture that encourages innovation, supports collaboration and appreciates the value of social capital and environmental concerns. In this regard plan policies will need to facilitate opportunities for growth and regeneration, investment across all sectors to create a resilient, inclusive and diverse city economy that is focused on economic recovery, job creation and emerging economic opportunities but also within the national framework on climate action.

Key enablers to deliver a successful city and region will be investment in improved national connectivity to and within the region and within the city, so that the Galway MASP will have capacity to collectively, with other regional cities deliver greater alternatives to the growth of Dublin. This investment in low carbon public transport, active travel modes and the connecting of road networks will support the advancement of the regional cities, their respective regions and progress and strengthen the Atlantic Economic Corridor (AEC) stretching between Donegal to Kerry. Galway City, located midway along this corridor can both benefit and contribute to the aim of establishing a connected spine of business and organisations that collaboratively can maximise its assets, attract investment and create jobs that will drive the NPF agenda for regional development that complements and balances with Ireland’s thriving east coast.

The daytime working population of Galway City and its suburbs, inclusive of commuters increased by 7% to 44,376 between 2011 and 2016 (CSO census). Half of this workforce are commuters similar with patterns recorded in 2011, predominantly from the County of Galway with a catchment into Mayo and Clare too. This reflects the significant regional economic role of the city and demonstrates that workers are willing to travel lengthy distances to access employment in the city owing to the quality and range of jobs opportunities. Those who travel outside of the city for work also remain relatively consistent at 5,571 workers.

Overall it is not possible to predict how the new and evolving hybrid work models and increased digitisation will impact on commuting patterns or demand for workspaces. This reflects the complexity of such changes which range from complete or partial remote working, off site digital hub arrangements, digital nomad work and other flexible preferences. As the landscape of work changes so will the implications on spatial planning. This plan needs to support the evolving arrangements and use the monitoring structure over the period of the plan to gauge the need for flexibility to respond to these shifting trends and capitalise on potential opportunities for delivering both economic and sustainable benefits.

Galway has shown economic resilience, even after the economic recession and the more recent impacts of the pandemic and proven to be a very dynamic city and a good place to continue to produce talent, attract investment and do business. This success is reflected in the capacity of the city in collaboration with state agencies to grow and consolidate its core workforce and continue to attract multinational and indigenous companies. It is currently a base location for some of the most successful Global ICT companies, has one third of the country’s medical device employees and has an emerging international digital gaming and media sector. This clustering has emerged due to the third level education environment providing a source of talent and a partner through collaborative arrangements with the private sector in research and innovation. The economic performance of the city is also sustained by employment provided in other economic sectors such as the commercial, healthcare service sector, tourism and public sector services. The accolades the city has attracted include, the “most efficient” Irish city in which to start a business, according to a 2019 study by the World Bank, the “Micro European City of the Future” (2016) and “Best Micro City for fDi Strategy” 2020 and 2021 and named by Lonely Planet as “one of the world’s top 5 cities in the world for travellers” in 2020. These bear testimony to the strengths, attractiveness and competitiveness of the city. This is further affirmed in the IDA’s ‘Driving Recovery and Sustainable Growth 2021-2024’ which states that the city of Galway is a crucial part of the West’s attractiveness to FDI. This is reflected in the IDA’s investment decisions which since the last plan delivered advanced technology buildings in Galway and upgrade work on the Business & Technology Parks in Mervue and Parkmore and on strategic sites at Oranmore and Athenry. It is noted that the comparatively low GVA, in national terms, of the West region would be significantly lower if not for the economic output of Galway City.

To sustain this economic growth and the socio-economic benefits it gives to the city, will require a continued focus on the key growth sectors and support for new and emerging sectors and innovation in industry including technology and other sectors. Maintaining and enhancing the attractiveness of the city will be important too in sustaining investment, quality employment opportunities and to attract and retain an appropriately skilled workforce to live and work in the catchment area. This focus is also important for the tourism sector which is a well-established contributor of employment in the city and region. The focus of our economic growth must be the creation of higher value employment.

In this regard the city needs to target sectors where Galway has competitive advantages, such as those relating to natural resources and to knowledge based resources. These would include sectors such as maritime and blue economy, renewable energy, fourth level education and training, research and development, creativity and innovation, digital, ICT and life sciences.

To deliver on the ambitious national plans for the transition to a climate neutral, circular and green economy, there is a particular need to mainstream environmental considerations into economic development policy and this integration is supported and promoted in the plan. In addition the importance of having a good economic strategy in the plan that supports sustainable economic growth, medium and high value employment creation, future skills development, commercial research and development and innovation is also seen as a contribution to the reduction of poverty and inequality, regional disparity and progress towards the UN SDG’s.

European Union (EU) economic policy includes a direct response for the need to address climate and recovery issues relating to Covid-19. It includes the Green Deal which is the EU’s Capital Spend which focuses on the green agenda and influences EU state economies, including Ireland. This will transform the direction of public and private sector investment, make the economy more sustainable and enable it to achieve the commitments made under the Paris Agreement and subsequently under Ireland’s Climate Action Plan and associated national legislation.

Not only will this require a transformation of the economy across all sectors it will also require an adoption of the circular economy principles. There will be a need to embrace newer forms of enterprise that responds to the challenge of resource, reuse and reducing carbon in manufacturing and consumption. The transition to a lower carbon economy and society is supported through policy and objectives embedded throughout the plan and in development management standards.

The National Planning Framework (NPF) is framed by ten national strategic outcomes which are the guiding principles on how best to direct the growing population and economy up to 2040. It realises the delivery of this vision by having a new regional focused strategy for managing future growth with a strong emphasis on having “… a competitive, low carbon, climate resilient and environmentally sustainable economy”.

This shift towards Ireland’s regions is supported by the enhanced development of the four regional cities of Galway, Limerick, Cork and Waterford. The NPF sees the regions as being supported by these cities and the cities being strengthened in their role as accessible centres of high value employment and services and focal points for investment to enable them to have the widest possible regional influence. The NPF gives recognition in particular to Galway City’s key role as a growth centre and driver for investment and identifies several key growth enabler projects for the Galway MASP area which can support and enhance Galway’s economic role.

The NPF is supported by the investment strategy of the National Development Plan (NDP) which sets out investment priorities to deliver on the goals of the NPF. The NPF review in 2021 included additional focus on priorities for climate action, housing and for addressing the impact of the Covid-19 pandemic and strengthening of the alignment of the investment strategy up to 2030 with these current development priorities.

The Government's Economic Recovery Plan (ERP) June 2021, is a response to the impact of the Covid-19 pandemic on society and the economy. It includes for a pathway for a sustainable jobs-led recovery. It focuses on four key pillars: sustainable public finances, supporting a return to work, re-building sustainable enterprises, and supporting a balanced and inclusive recovery. The plan includes more than €3.5 billion in spending supports. The ambition of the ERP is to have 2.5 million people in work by 2024, exceeding pre-pandemic levels. Alongside the ERP, there is the National Recovery and Resilience Plan which focuses on areas including innovation, skills, resilience and productivity, as well as the changes flowing from the Government’s climate action commitments with the aim of working towards a sustainable jobs-led recovery and a just transition to a low carbon economy and digital economy.

Reflecting EU policy, national plans show a growing commitment to climate action and a shift in policy, action and investment towards a transition and adaptation to achieve progress towards green growth and sustainable development to meet 2030 and 2050 climate action targets. This approach highlights the need for this transition to be a fair one that will need a range of social interventions to protect workers and their livelihoods when economies are shifting to more sustainable production in the interests of combating climate change and protecting biodiversity.

In recent publications the National Competitiveness and Productivity Council (NCPC) has identified key challenges to strengthen competitiveness and productivity, inclusive growth and to support businesses in the transition to a sustainable, carbon-neutral economy. They see the need to ensure that the transition to a sustainable, carbon-neutral economy delivers for all parts of society. There is also a need to encourage opportunities for upskilling and the opportunities to market climate action as a competitive advantage. They identify the need to invest strategically in Ireland’s physical infrastructure, and resolve long-standing issues relating to cost of housing and childcare. They also support the need to continue targeted pandemic supports, address issues associated with Ireland’s high cost economy and explore how productivity could be boosted through changed work practices and digitisation. Although pitched at national level many of these issues apply to the Galway context. In land use and spatial planning terms, support for delivery of critical infrastructure such as housing and transport, flexibility to address the changing work landscape and embedded policies to drive an economy towards carbon-neutrality, will contribute to improving competitiveness of the city.

The Northern and Western Regional Spatial and Economic Strategy (RSES) 2020-2032, distils NPF objectives to regional level. It has a focused vision for a region that is smarter, greener, more specialised and connected, with a stronger and more compact urban network. It includes a Growth Framework incorporating ‘Five Growth Ambitions’ that links strategic and operational challenges with prioritised capital interventions. These growth ambitions focus on building a competitive and productive economy, a long term vision for energy supply, respect for the natural and built heritage, a well-connected region, a liveable environment that commits to sustainability and inclusivity and a region supported by the necessary economic infrastructure to support compact growth and resilience.

In particular the RSES includes for specific development objectives for Galway City and environs under the Galway Metropolitan Area Strategic Plan (MASP). The MASP envisions Galway to grow to be a globally competitive urban centre and owing to the current strong international and indigenous investment presence, continue to have a pivotal function in the development of the region. The MASP identifies suitable locations for strategic employment development. It focuses on compact growth and direction of development onto key city centre regeneration and strategically located industrial/enterprise lands throughout the city. It recognises the high value of the third level educational institutions and workforce skills. It identifies potential to further develop the modern technology industry, tourism, retail, gastronomy, research/ education and the marine sector. It views advancement in these sectors as key to drive regional economic growth. The MASP also recognises the distinct image of the city, its quality of life, high standards of education, and its culture and historic and amenity setting as key assets to the economy. It also identifies strategic investment in critical services, road networks and sustainable transport infrastructure and public realm as essential to enabling the MASP area function and develop.

The Galway City Local Economic and Community Plan (LECP) 2015-2021 is the local level strategy for economic, social and community development in Galway City. It is a collaborative plan for the city, prepared by the local authority in conjunction with the community input from the Local Community and Development Committees (LCDC). The LECP is based around the vision that “Galway will be a successful City Region with a creative, inclusive and innovative ecosystem in place to ensure its sustainable development into the future". The plan includes for five high-level goals for Galway City. That is to be a world-class, creative city region; an innovative city; an equal and inclusive city; a sustainable, resilient urban environment that is the regional capital of the West; and a city that promotes the health and well-being of all its people. The LECP notes Galway City must capitalise on the city’s strengths to retain competitiveness. Digital technologies in particular are seen as one key to future proofing the city and enabling the transition to an international smart sustainable city. The LECP is currently being reviewed. It will take account of the challenges and the recovery presented by the Covid-19 pandemic and Brexit implications to ensure that a local level framework is in place to support economic growth, social and community improvements. Collectively the LECP and Development Plan provide a strategic framework for integrated planning in the city and must be consistent.

There is a complex and comprehensive eco-system for the support of enterprise start-up and growth in the city which includes a range of targeted statutory and non-statutory supports. These include IDA Ireland, Enterprise Ireland, the Local Enterprise Office (LEO), a range of business incubator facilities, both fourth level campus based on and off campus facilities and sectoral (ICT/ life sciences / creative sectors). A further five incubator facilities are under development at present. In addition to this there are sectoral specific research and development facilities which facilitate academic and commercial collaboration, a range of commercial and industrial parks and a range of commercial office space being developed at the city core and manufacturing facilities at the fringes of the city.

Allied to that there are a range of statutory organisations delivering support programmes to develop Social Enterprise, the Circular Economy and the regional skills resource. A Regional Enterprise Plan is currently being finalised for the West Region to identify the key economic areas to be developed.

The continued success and economic growth in the Galway MASP area is linked to a wide range of contributing factors which consists of the need for a high quality transport system including for sustainable mobility, good connectivity and a modern public transport system. It also requires a well-functioning housing market and good educational and community supports. The offer of quality lifestyle choices, good recreational and cultural experiences and a quality built and natural environment are assets that contribute to the economy in attracting and retaining a skilled workforce and sustaining the tourism economy.

Galway is advantaged in having a number of these attributes and a spatial strategy and investment direction in the RSES, NPF, NDP and City Plan to deliver the balance. The Core Strategy supported by appropriate spatial policies and objectives in the plan will further enable the overall framework needed for the local economy to prosper. Lands zoned and designated for regeneration that can support enterprise is anticipated to meet the projected employment increase included for in the RSES and the MASP at locations that are integrated with the Galway Transport Strategy in particular for sustainable transportation choices and with the settlement strategy to encourage ease of access and to nurture the neighbourhood concept.

The main direction for expansion of employment will be onto designated regeneration sites, strategic business parks and on existing health and education campuses that are well aligned with the measures in the Galway Transport Strategy. The development of the retail hierarchy of the city centre, district neighbourhood and local retail centre aims to enable commercial and tourism related activities.

Together with the MASP, other strategic regional employment plans, the LECP, investment strategies and partnerships in implementation, the City Plan will enable the city to continue to flourish economically.

|

Policy 6.1 General policy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.2 Economic Activity

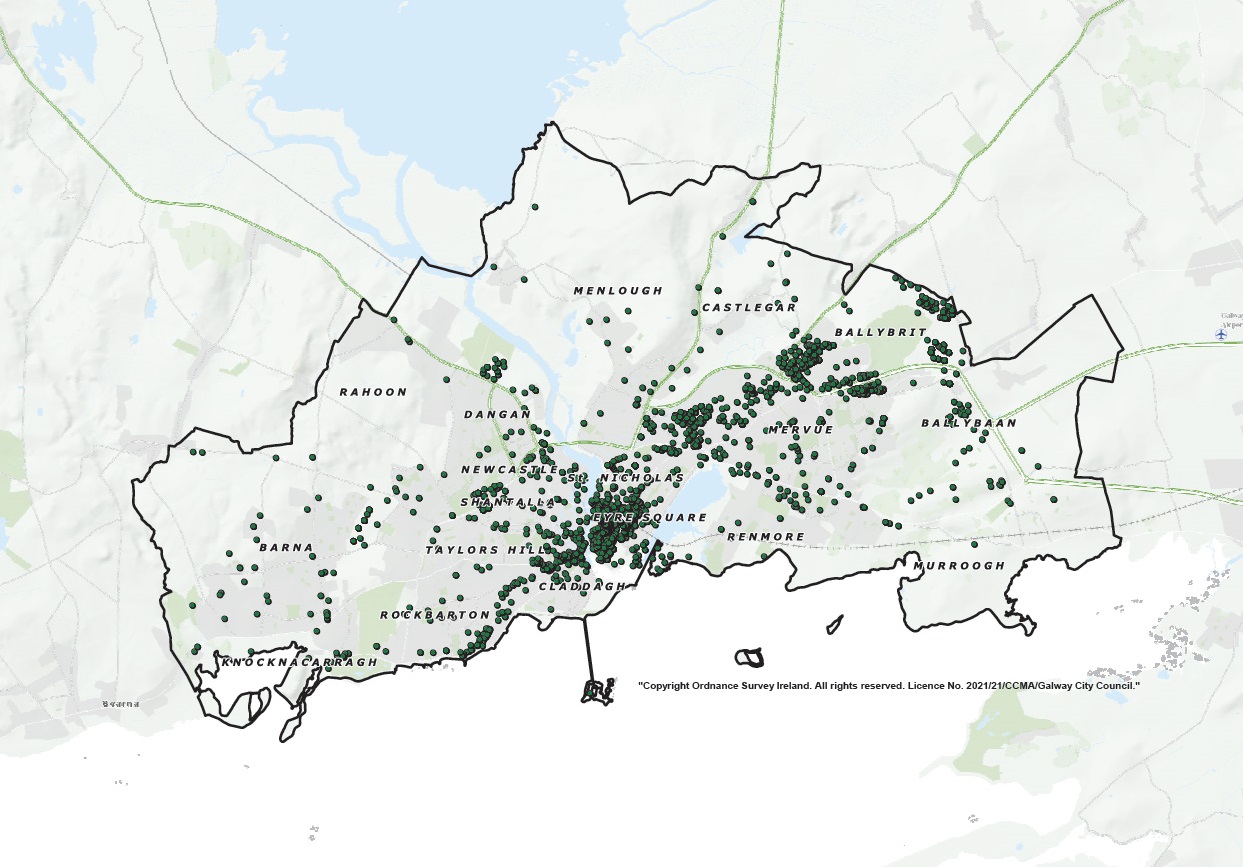

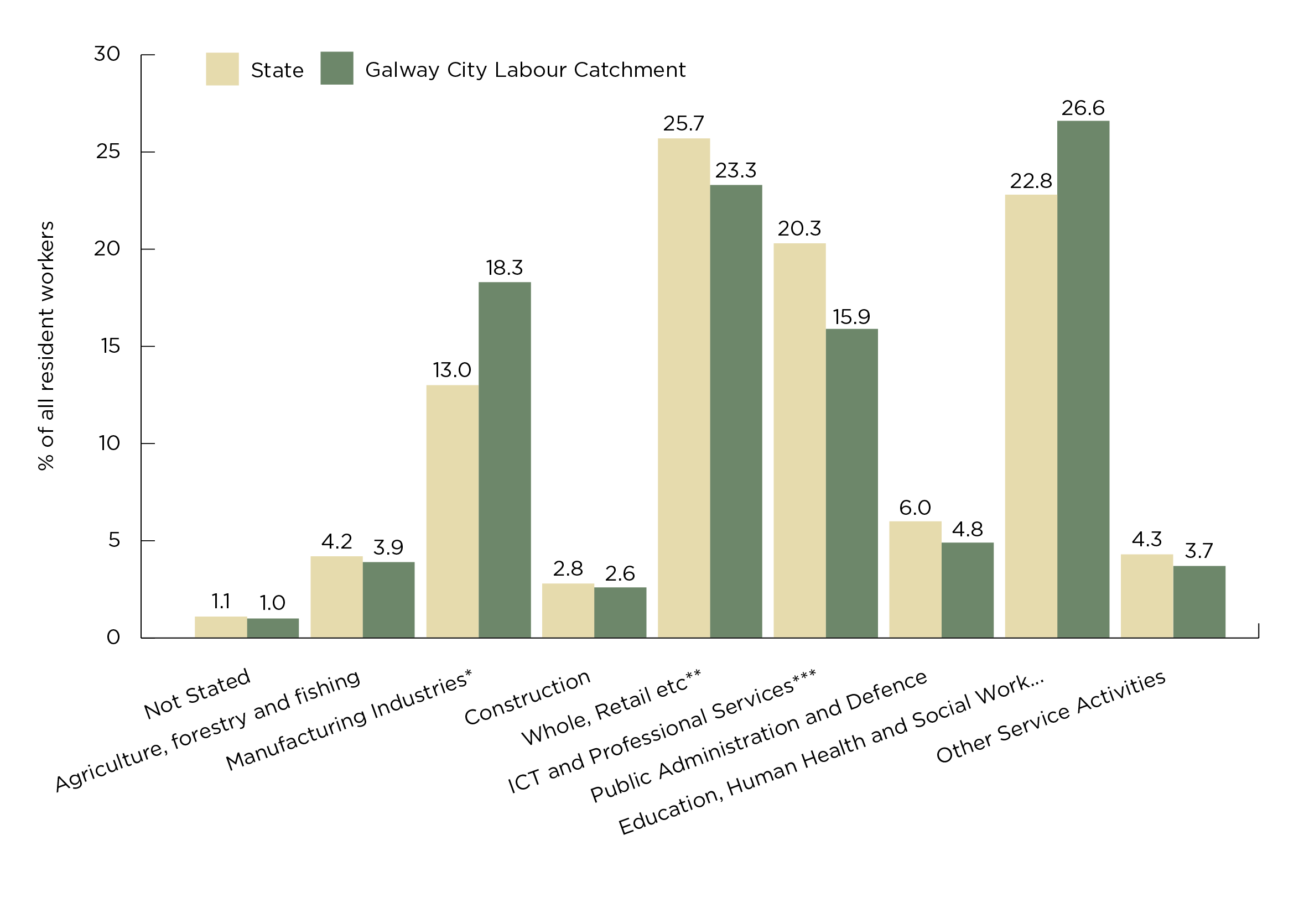

Galway City plays an important regional role in providing for a diverse range of economic activities, services and employment opportunities and has considerable potential for further development and capacity for new enterprises. The CSO Census (2016) provides a sectoral breakdown of employment within the Galway City labour catchment relative to the national breakdown – see figure 6.1. It shows that the largest sector of employment within the city labour catchment is the services related ‘Education, Human Health and Social Work Activities’ which accounts for 26.6% (18,655) of the total working population of 44,376, approximately 4%, higher than the State average. This reflects the City’s position as a regional centre for health care and third level education. ‘Wholesale, Retail and Commerce’ (23.3% or 16,360) and ‘ICT and Professional Services’ (15.9% or 11,125) record as significant employment sectors with both below the State average and ‘Manufacturing Industries’ (18.3% or 12,855) is the fourth most important sector and is much higher than the State average of 13%, possibly reflecting the high levels of employment in the Med tech clusters in the city.

Figure 6.1: Industry Profile of those living in the Galway City Labour Catchment, 2016

Figure 6.1: Industry Profile of those living in the Galway City Labour Catchment, 2016

Source: AIRO & CSO POWSCAR

The GeoDirectory (2020 – Q3) records 3,669 commercial addresses in the city, an increase of almost 10% from the 2016 record in the previous plan. These economic activities span the city showing there are well defined concentrations of activity at particular locations. These are concentrated mainly in the city centre, suburban districts and neighbourhood centre areas, near college and hospital campuses, enterprise lands in the city and straddling the eastern boundary of the city.

Figure 6.2 Galway City Showing Pattern of Commercial Activity

Source: Geo Directory NACE codes (2020)

The city centre remains the focus of the main commercial activity. This reflects the concentration of the major retailers, the hospitality sector and the strong presence of health, educational and general professional services within the city core area. There is an emerging concentration of FDI and indigenous high tech office uses on regeneration lands in the centre. The city centre is also the recent location of a growing innovation district which hosts start-ups and incubator type enterprises. The main business and technology sector, including the clustering of the ICT and Med Tech and medical device manufacturers are located in the east of the city at the strategic employment sites in Ballybrit, Mervue, Parkmore and immediately outside of the city boundary towards Oranmore.

The east side of the city also supports the main bulky goods, wholesale and motor trade activity and also the smaller manufacturing enterprises located at Liosbán and along and off the Tuam Road area. In addition, this side of the city supports significant employment at three strategic hospitals at Merlin Park, the Galway Clinic, and Bon Secours and also at GMIT, a third level institution.

The west of the city has a less dense employment environment than the east. Close to the city centre there is a significant concentration of health services at UHG and educational institutions at NUI Galway and a cluster of large secondary schools on the periphery of Salthill. In addition there is a concentration of tourist accommodation and hospitality services reflecting the proximity of the attractive seaside location at Salthill. In the western suburbs and the more established suburbs closer to the city centre there are concentrations of activities in the district centres and also a legacy of smaller neighbourhood centres both of which support retail, general commercial and professional services. In contrast to the east the concentration of business parks is smaller and more diverse in nature.

6.3 Employment Sectors & Clusters

6.3.1 Commercial Sector

As referenced almost a quarter of the workforce in the city is in the commercial or allied trade sector and as such the sector plays a major role in maintaining a strong economy in the city and the region. A significant concentration of this activity occurs in the city centre, the edge of the city centre, at Salthill and in the suburban district centres and neighbourhood centres. The Core Strategy has identified opportunities both at the peripheral commercial locations and in the city centre that can expand, re-develop and densify to meet future growth demands sustainably and qualitatively.

Retailing in particular contributes to the commercial life of the city and is key in conjunction with the hospitality, restaurants, café culture and entertainment sector to support the competitiveness and the attraction of the city for both residents, the high student population and the tourism market. The medieval core, the walkability and the waterside location enhances the experience of the commercial core giving it added value.

While there is scope for infill, re-development and refurbishment on the existing city centre footprint, it is constrained in scale and form being located primarily in the historic core and cannot easily accommodate larger modern commercial floorplates. However the adjoining large scale designated regeneration sites at Ceannt Quarter and the Inner Harbour (12ha in total) and to a lesser extent on the opportunity site at Eyre Square East (2.6ha) can provide a seamless link from the city core to accommodate expansion of commercial activity integrated with other uses. Commercial lands at the edge of the city centre on the Headford Road (covering approximately 13 ha in total), currently support a mix of uses including bulky goods, surface car parking and a single storey, internal mall shopping centre that would benefit from refurbishment. This area can with re-development and improved urban structure regenerate to provide for a mixed used area suitable for accommodating additional and higher value commercial uses and a critical mass of residential use. The NUI Galway lands at Nun’s Island are also the focus of regeneration and have capacity for innovation and collaborative ventures also. Section 2 of this Chapter further expands on the spatial policy approach to retailing in the city, coupled with the direction for a mix of uses on the regeneration sites included for in Chapter 10.

The direction set out in the MASP is for a strong policy focus to preserve and enhance the city centre as the primary commercial area within the MASP area, supporting a regional role for a range of retail, commercial, tourism, social and cultural activities. The Core Strategy reflects this approach and reinforces the importance of integrating the supporting measures in the GTS to improve accessibility and the quality of the environment in the city centre complemented by the Public Realm Strategy measures. These together will contribute to the vitality and vibrancy of the city centre.

Retail is an activity that is considered to be included in the broad commercial sector but as there are specific Section 28 Ministerial Guidelines - Retail Planning Guidelines for Planning Authorities (2012) there is an obligation to give this sector specific assessment and policy focus. The guidelines indicate that the retail sector is an essential part of the Irish economy and a key element of the vitality and competitiveness of urban areas. In this regard the guidelines consider that it is important that the Development Plan provides a clear framework for the continued development of the retail sector in a way that provides certainty for retailers and communities in the relevant policy framework. This is included for in Section 2 of this chapter.

|

Policy 6.2 Commercial Sector |

|

|

|

|

6.3.2 Industrial Sector

The pattern of high value industrial employment has been mostly influenced by developments that commenced in the 80’s and 90’s at sites on the fringe of the city driven by IDA and Enterprise Ireland investment. These strategic employment centres are located at Dangan Business Park, Mervue Industrial and Business Park, Parkmore Business and Technology Park, Ballybrit Business Park and Briarhill Business Park. They include for a range of industries with a strong focus on the life sciences, medical technologies and internationally traded ICT services and software. They broadly require office and manufacturing type floor spaces and include a strong FDI presence and also accommodate key indigenous enterprises. There are Industrial (I) zoned lands within the city located at Briarhill, Ballybrit and Rahoon to accommodate additional demands. There is a significant balance of lands in the MASP area that straddles the City/County boundary on the IDA lands at Parkmore (38ha) and the unoccupied strategic IDA site (27ha) at Oranmore. These areas have the potential for additional employment with good opportunities for increased accommodation through expansion on undeveloped lands, densification and re-organisation. On some lands not under control of the IDA/Enterprise Ireland there are opportunities for growth in the general manufacturing and commercial trade sectors thereby adding to the opportunities for a diversity in employment types. Following recent international trends a number of large floorplate office developments supporting both FDI and indigenous development are establishing nearer the city centre on regeneration sites at Bonham Quay and Crown Square. This investment accords with the need for regeneration and are creating a stimulus for growth of similar development at these locations and the direction for greater use mix including for residential use which can support the influx of workers.

Another key opportunity site for industrial and enterprise use is the former Galway Airport site. These lands were purchased by Galway City and Galway County Council when the airport function ceased with a vision to re-use for economic purposes. This 46 ha site is identified in the NPF as a growth enabler and being located in the MASP area the Plan includes an objective to unlock the potential of the lands in the lifetime of the strategy. An analysis of this site has been undertaken by Galway County Council which includes a framework for the potential redevelopment of the site for economic benefit of the wider Galway region. A supporting objective for this framework is included in the current Draft Galway County Development Plan 2022-28.

|

Policy 6.3 Industrial Sector |

|

6.3.3 General Industry and the Advanced Manufacturing Sector

Traditional manufacturing enterprises have been in decline for a number of years in Galway. This has not been a completely negative trend as there has been an increase in the skills base in the city and upward social-economic mobility reflecting the broadening of higher value employment opportunities. There remains a need to retain lands to accommodate light industrial uses and services which are required to support the whole of the economy needs. Currently, these enterprises are particularly concentrated at Mervue, along and off the Tuam Road and the Monivea Road. These lands predominately accommodate light industry, small manufacturing and service units, small scale offices, warehousing and some bulky goods including motor showrooms. These industries are predominantly indigenous owned and operated and support entrepreneurship ventures. There is a need to protect these lands for such industrial uses which can come under threat from higher value uses and this can be done effectively through policies and land use zoning objectives. These lands will also accommodate businesses that do not fall into the categories supported by Enterprise Ireland or the IDA and will also provide opportunities for start-up indigenous businesses and the new emerging economies in the city. On some such lands in transition, where regeneration is more appropriate, such as at Sandy Road, the Council will support the re-location of the existing uses to more appropriate locations.

The Harbour Enterprise Park was developed originally as an adjunct to the adjacent harbour. It has evolved in a diverse manner not exclusively with port related activities. It currently supports a number of industries, some of a heavy industrial nature, large oil storage base and the Bus Eireann garage and maintenance depot. The future of these lands will be linked to the current proposal at consent stage to significantly expand the port and emerging proposals to regenerate the inner harbour lands closer to the city centre.

6.3.4 Knowledge Economy, Technology Industries and Life Sciences

Ireland is pursuing transformation to a knowledge economy which is considered a pathway to maintain prosperity in the city. Galway is at the forefront of this trend with a strong presence of knowledge based and technology industries, a supporting skills base and collaborative and innovate third level education environment that supports skills demands, research and development. NUIG is a host for the Insight SFI Research Centre for Data Analytics. Insight is an SFI Research Centre that supports 450 researchers across areas such as the Fundamentals of Data Science, Sensing and Actuation, Scaling Algorithms, Model Building, Multi Modal Analysis, Data Engineering and Governance, Decision Making and Trustworthy AI. Cumulatively there are over 190 technology companies including a range of start-ups in the Galway MASP area, including many leading multi-nationals with the life sciences particularly MedTech sectors represented. Their presence is an indicator of a highly skilled workforce.

Complementing the strength of the knowledge industry is the Business Innovation infrastructure such as the Portershed Innovation Hub, Galway Technology Centre, GMIT iHub Galway, NUIG Business Innovation Centre which are collaborative ventures between the public sector, private sector and educational institutions in the city centre. Such hubs nurture innovation labs and business incubation in the technology and high value start up sector. These facilities have been developed using the Regional Enterprise Development Fund. In the creative and digital space an additional innovation centre CREW has also secured capital funding. Innovation growth is also being supported under the Disruptive Technologies Innovation Fund (DTIF) established under Project Ireland 2040. Galway has benefited significantly from this fund which supports research and development projects in areas such as life sciences, medical devices, ICT, artificial intelligence, manufacturing and environmental sustainability.

This strong culture in the city of application of innovative technologies creates an environment that can support Galway’s transition to becoming a Smart City. A Smart City is where an ecosystem of people, devices and things communicate and collaborate. It is a city where the Internet of Things (IoT) is used to detect, analyse and share information that enables an urban area and its services to operate more efficiently, economically and to engage more effectively with citizens. Developing smart cities begins with small sized initiatives. For Galway City this includes the introduction of an electric vehicle (EV) local authority fleet with on-site fast charging, smart solar compactor bins with higher capacity and reduced collection cycles, use of intelligent transport solutions to manage transport systems, green schools initiatives where mode shift and air quality can be measured. Each initiative results in data that can progressively build on another solution and can through the use of technology measure successes and adaptations required for bigger actions. This approach is supported in the RSES where a partnership approach between the NWRA, the Western Development Commission and the Insight Centre for Data Analytics at NUI Galway are working on the development of public infrastructure and regional governance structure using technological solutions that will allow all stakeholders in all of the region, including Galway City to participate in decision making and enjoy an enhanced environment. On a national level Galway City is currently a participating member of the All-Ireland Smart Cities Forum. This is a partnership which focuses on the advancement of cities cooperatively through deployment of and value generated by a Smart City programme where there are shared learnings.

|

Policy 6.4 Knowledge Economy, Technology Industries & Life Sciences |

|

6.3.5 Enterprise & Innovation Sectors

A strong economy supported by enterprise and innovation is one of the strategic outcomes of the RSES. There is a growing importance on the promotion and the development of knowledge based enterprise and support research and innovation hubs and incubation facilities within the city in association with other agencies. The NUI Galway Strategic Plan “Shared Vision, Shaped by Values Strategy 2020-2025” will lead the transformational change of the city and region informed by the national policy of balanced regional development and sustainable cities as outlined in Project Ireland 2040. It aims to achieve this by sharpening the focus of teaching, research and innovation using the UN Sustainable Development Goals as a blueprint to achieve a better and more sustainable future. Implementation of the plan will take collective effort over five years to achieve goals.

Funding received under the URDF funding stream 2020 will advance plans for an additional hub, the Galway Innovation and Creativity District, a joint venture between Galway City Council and NUI, Galway. This will include for a riverside regeneration project at the campus and on NUI Galway properties at Nun’s Island and will strengthen the linkages between business, research and city living.

Emerging business models, such as social enterprises are on the increase, and are those that work primarily to improve the lives of people. Their core objective is to achieve a positive social, societal, or environmental impact. Like other businesses, social enterprises pursue their objectives by trading in goods and services on an ongoing basis. However, surpluses generated by social enterprises are re-invested into achieving their core social objectives, rather than maximising profit for their owners. They usually include work to support disadvantaged groups such as the long-term unemployed or to address issues such as food poverty, social housing, or environmental matters. This plan recognises the value of social enterprise in the city and will facilitate and support the main objectives of the first National Social Enterprise Policy for Ireland 2019-2022 through building awareness of social enterprise, and through supporting the provision of social enterprise incubation infrastructure required for growing and strengthening social enterprise and achieving improved alignment with relevant government policy areas.

Galway City Council is involved in the delivery of a range of supports to social enterprises through initiatives such as the Social Inclusion and Community Activation Programme (SICAP), the Community Enhancement Programme, provision of subsidised enterprise space and grant aid direct to social enterprises. This plan recognises the potential of social enterprise to contribute to the development of a sustainable and circular economy and local job creation and supports the social enterprise objectives included in the LECP.

|

Policy 6.5 Enterprise & Innovation |

|

|

|

|

|

|

6.3.6 Office Sector

Office use includes for a broad range of activity. It can include direct services to the public such as professional, financial, business or can have more of a corporate nature and technology driven focus classed as specialist offices. With increased trends towards a knowledge based, digitised economy there is increasing overlap between these types. There are a number of locations in the city that accommodate offices. The larger technology type evolving from manufacturing models are predominantly located on the fringe business parks whereas the more general types are located in the city centre. More recent development phases of growth has reflected international and national policy direction trends for large office type businesses to establish at locations closer to and adjoining the city core.

The main focus for general office use still remains in the city centre, reflecting the prime role of this area, and the synergies that are created between retail offices and general office use and the contribution these services make to maintaining vibrancy and viability of urban space. Office uses tend to be high density workplaces and therefore the most suitable locations are in areas that have access to public transport and by active modes of travel.

The District, Neighbourhood and Local Centres are also locations where offices accommodation is supported of a nature and scale that does not detract from the primacy of the city centre and doesn’t prejudice the development of a balanced mix of uses at these locations. Offices at these locations will be assessed in the context of their scale and type and relative to the size of the centre and associated neighbourhood catchment and accessibility by existing and/or proposed investment in public transport.

Large plate technology driven offices or specialist offices which have a high density of employment have capacity to develop further and expand in the business parks on lands zoned for industry and commercial/industry. Currently these office types are located at Ballybrit, Rahoon, Parkmore, Tuam Road, Monivea Road. The Plan in Chapter 10, reflecting the NPF agenda for compact growth, mixed use development and regeneration has identified a number of city centre and near city centre sites that are suitable for large scale development that can accommodate large floorplate office developments. There have been a number of major office campus developments of this type consented and are at development stage since the last Development Plan, reflecting the new trend in the location of technology office space. Interest in further large scale office development at the fringe locations will not be displaced by the city centre trends and expansion and investment by existing companies at these locations confirm their continuing long term investment in these lands and the need for the Plan to continue to accommodate the parallel development at these locations in addition to promoting regeneration sites.

In the interests of promoting the neighbourhood concept and sustainable movement patterns the location of small scale offices which provide local services such as that of GP/dental practices are encouraged to co-locate with other local services in the area. Such uses are open to be considered also in housing areas subject to assessment of their impact on amenity and traffic considerations. Home based offices and activities will also be open for consideration, but only where their nature and scale demonstrate that they can be accommodated without detriment to the existing residential amenity.

As referenced previously it is not possible to predict how the new and evolving hybrid work models and increased digitisation will impact on the demand for office space. With more people working from home the role of the office is shifting. One of the negative consequences of remote working is the reduction in collaboration and team work, which office based enterprise offers. The current thinking from the investment and property industry is that demand for office space is likely to remain at similar levels in the medium/long term, with occupiers likely to look at reconfiguration of existing office space, rather than reducing commercial footprints. The evolving arrangements need to be monitored over the period of the Plan to gauge the need for flexibility to respond to these shifting trends and capitalise on potential opportunities for delivering both economic and sustainable benefits.

|

Policy 6.6 Office Sector |

|

|

6.3.7 Healthcare and Education Sectors

Healthcare and knowledge based services and the associated employment and economic activity are particularly important in the city and engage a significant level of the workforce. The NPF identifies good access to a range of quality education and health services, relative to settlement scale as a key strategic goal and acknowledges that it contributes to making places attractive, successful and competitive. The RSES further reflects the importance of both and with high speed broadband connection notes the potential to use modern technologies to provide virtual delivery of some services to remote areas and to increase efficiencies within the operation of these services. The MASP recognises that the healthcare and knowledge services in the city have a significant regional function. With significant targeted growth in the MASP it is anticipated that this regional function will increase and that expansion and advancement in these services will be required. This will require both enablement through land use zoning and investment in improved accessibility through implementation of the GTS measures.

Galway is the centre for regional health care services for the West Region with Galway University Hospitals (Merlin and UHG) providing a secondary, regional and supra-regional service in respect of cardiology and cancer services. Sláintecare and the HSE supported by the NDP include for a new Emergency Department (ED) at UHG and a new elective hospital within the city. This will add to the existing public hospitals and complement the services provided in the two private hospitals. Community and specialist medical services can be accommodated within district, neighbourhood and local centres and be directed to the city centre area. Primary health care centres have been identified as important in the RSES, where they are encouraged to locate near their catchment and close to existing local services.

The advantage of having three third level institutions in the city - NUI Galway, GMIT and GTI is reflected in the high attainment levels of education in the city, the skilled nature of the workforce and the framework available for continued training, research and collaboration with industry. In addition the presence of a large third level student population of over 26,000 in the city contributes greatly to the local economy and adds to the vibrancy of diversity in the city.

The Plan though supportive policies, land use zoning and co-ordination and integration of key pieces of infrastructure enables the further development of all healthcare and educational institutions.

|

Policy 6.7 Health & Education Sector |

|

6.3.8 Tourism Sector

The sustainable development and promotion of a successful well managed tourism industry has been identified in the RSES as critical to the economy of the region. Galway City and County accounted for 59% of the tourist visits in 2019 for the North West region and benefits greatly both economically and from the added vitality it brings. Prior to the year impacted by the Covid-19 pandemic Galway City and County hosted up to 1.7m international tourists and 1 million domestic tourists per year as recorded by Tourism Ireland. Success has been further reflected in achieving the status of “the fourth-best city in the world to visit in 2020” by Lonely Planet and one of the top two friendliest city in Europe" in 2020 by Condé Nast Traveller readers’ Choice Awards survey. Currently the tourism sector is described by Tourism Ireland as in a survival stage up to 2022 and then it will be in a rebuilding stage after, but where the longer term impacts of the pandemic changes in the aviation sector and the impact of the climate crisis are as of yet unknown.

Notwithstanding this it is anticipated that the city will recover its tourist trade, and has resilience owing to the significant scale of the domestic market and associated repeat visits. The distinctive cultural heritage, vibrancy, intimate urban fabric and the attraction of being a traditional seaside city have made this sector a success in the city and are key assets contributing to the re-building of this sector. The year round festival calendar is also a significant tourism product, sustaining services and ensuring year-round bed nights. Hosting the European Capital of Culture 2020, although challenged owing to the Covid-19 pandemic, still helped raise the international profile of tourism in Galway. The innovation brought about through the initiatives for outdoor dining and the framework being development nationally for the night-time economy will also enable more diversity in the city offering.

A Tourism Strategy 2020-2025 has been prepared by the City and other main stakeholders and redefined what the ‘Galway’ tourist experience entails and focuses on actions that can support and develop the visitor experience. The Development Plan supports this strategy and encourages and facilitates in particular sustainable tourism and the broadening initiatives with respect to culture, heritage, emerging greenways and blueway activities on the waterways.

The RSES highlights the success of the Wild Atlantic Way, stretching along the coast of the region from Donegal and extending to West Cork and the economic benefit it demonstrates for marketing Ireland as a clean, green holiday destination. In line with this Galway, as the only city along this route, is the focus for significant funding from Fáilte Ireland, to enable the enhancement and extension of the city museum which will be redeveloped and rebranded as the Atlantic Museum Galway.

The MASP has a focus on tourism also and identifies the unique environment of Galway City and its environs including the extensive coastline, urban beaches, river and lake, the waterways and the city canal system as unique tourism assets. Funding under the destination town funding stream will further explore the potential of these areas as blueways that can support facilities for tourist activities.

In general the Council contributes to the development of tourism in the city through a variety of different synergistic measures including improving accessibility, environmental maintenance and improvements and through, the provision of recreation and amenity areas, public realm measures, protection of the natural and built heritage and the facilitation of the development of visitor activities and attractions.

Tourism covers a wide variety of different activities within the city. Many of the policies and objectives set out in this Plan will support and facilitate the development of tourism and tourism infrastructure. This includes the enabling of tourist accommodation, the general hospitality sector and specific tourist facilities. These can benefit both visitor and citizen alike and contribute to the vitality, local economy and ultimately job creation.

|

Policy 6.8 Tourism Sector |

|

|

|

|

|

|

6.3.9 Marine Sector & Renewable Energy

Galway has a strong maritime culture and tradition, being located in an area with a long trading history. The marine sector, while already an important sector for Galway City and County given its location and accessibility to the wider ocean, has great potential to expand and tap into the broader global marine market, including for seafood, tourism, renewable ocean energy and application for health and technologies. The marine area also has considerable amenity benefits ranging from unique ecology and habitat, beaches, open space, greenways, blueways and the support for water based leisure and recreational activities.

In line with the requirements of EU Directive on marine spatial planning, the National Marine Planning Framework (NMPF) 2021 was approved with supporting legislation drafted to regulate the maritime area. The NMPF provides the national framework for marine-based human activities and outlines the government’s 20 year vision, objectives and marine planning policies for each marine activity, balanced with the need to protect the environment. The Framework gives direction to decision makers (including the local authority), users and stakeholders towards strategic, plan-led, efficient and more sustainable use of national marine resources.

In the city the main focus of maritime economic activity is at the Port of Galway, a port classified in national port policy as a port of Regional Significance (Tier 3). The port and associated lands support shipping and marine transport. Goods imported mainly include petroleum products, bitumen and steel and intermittently large scale project related cargo such as wind turbines, while exports include limestone and recyclable metals. The main marine transport service is the passenger ferry operating from the port which services the strong tourism trade on the Aran Islands. The associated enterprise lands support a number of enterprises including port linked activities and offers storage space for shipping cargo. Leisure and tourism is supported thorough the facilitation of local sea based activities, a 40 berth pontoon marina and intermittent visits from international cruise liners.

As the port capacity is extremely constrained and facilities deemed inadequate for developing the business to a modern international standard the port currently have proposals with An Bord Pleánala for a significantly scaled extension to the harbour area. The proposals for re-development and extension includes for reclamation of 27 hectares, construction of commercial quays deep-water port facilities, provision of marina and aqua sport facilities. This project is supported in the Plan as it is considered to have potential to contribute to marine enterprise and employment, the capacity to boost tourism and also provide for additional public realm with capacity for hosting large events. The benefit to the city also is that with re-location of activities further off shore it will enable the re-development of the designated regeneration site at the inner harbour, as outlined in Chapter 10 to provide for a new and compact, mixed use quarter on the waterfront and adjacent to the city centre.

The Galway MASP area is advantaged in having the Marine Institute, a national state agency located within the MASP area at Oranmore. It is key in safeguarding national marine heritage through research and environmental monitoring and contributes to informing national policy. It also supports marine research, technology development and innovation which both supports the industry and leverages interest in new marine related enterprises while also linking collaboratively on projects with GMIT and NUI Galway (e.g. SEMRU Socio-Economic Marine Research Unit).

The NPF includes for an objective to support the sustainable growth, development and continued investment in the maritime economy. The RSES supports the Port of Galway and the expansion proposals and sees this project as a key strategic priority for the region that will enable further investment in the maritime economy, tourism and connectivity, all of which are perceived to have both city and regional benefit. In view of the poor connectivity within the Northern and Western region relative to other regions the RSES supports examination of the feasibility of the designation of Galway Port as an EU TEN-T so that it can be integrated into and link with the Europe-wide transport network. The MASP also recognises that the planned improvements of Galway Harbour facilities can strengthen the NPF ambition for Galway to be a strong regional city and improve competitiveness.

The marine environment has also been identified as a potential driver to significantly reduce greenhouse gas emissions and accelerate the move to cleaner energy in line with national policy. The RSES identifies the huge potential for growth in renewables as part of the growth ambition for the economy and employment in the region. In particular it identifies off-shore wind energy as a considerable resource to be explored and the need for adequate provision of land based infrastructure and services. This reflects the aims of The Offshore Renewable Energy Development Plan (OREDP) which identifies the opportunities for off-shore wind and ocean energy and the potential for creating jobs in the green economy. As the western seaboard and the North Atlantic is likely to be a key strategic zone for the testing, installation, and continued expansion in the area of marine renewables the Port of Galway is ideally placed to tap into these emerging marine enterprises associated with the sustainable energy sector and the offshore renewable energy sector. The National Marine Planning Framework (NMPF) includes an objective to identify the potential for ports to contribute to off shore renewable energy and for relevant, plans and policies related to the identified port to encourage development in such a way as to facilitate offshore energy and related supply chain activity. In this regard the current plan supports this type of enabling development at the Port of Galway subject to all proposals being rigorously assessed to ensure compliance with environmental standards, amenity and visual requirements and all other requirements that minimise the impact on the marine environment, marine ecology and other maritime users. Supporting this activity can bring substantial socioeconomic benefits including employment and income opportunities, transferable technology and skills development and opportunities for a just transition to green jobs with potential to replace those currently related to fossil fuel imports.

|

Policy 6.9 Marine Sector & Renewable Energy |

|

|

|

|

6.3.10 Creative Economy & Gastronomy Sectors

Galway is home to a strong, vibrant creative economy, recognised at national and regional level. These can be broadly classified into culture which includes the performing arts, publishing, and education, creative which includes media design,lens-based content including gaming and audio-visual, software and app development, research and development, and craft which includes traditional craft, print, electronic and other manufacturing. Recent research by the Western Development Commission indicates that prior to COVID-19 pandemic this sector was growing fast and increased employment by 44% between the years of 2013-2018, with an estimated value of almost half a billion in 2018. In the city the strongest area of growth recorded related to the creative area, mainly in relation to software and app development. However it is also here in the city where 70% of the west region’s cultural enterprises are located.

The cultural presence of the Druid Theatre Company and the Galway International Arts Festival, the accolade of city's designation as a UNESCO City of Film and the European Capital of Culture 2020, the high calibre craft industry and media and design development all contribute to the diverse creative ecosystem in the city.

The benefit that the city accrues from this vibrant creative, arts and culture scene is broader than simply employment and sales. The culmination of the creative activities in the city spurs innovation across all of the economy and contributes to numerous other positive impacts ranging from tourism, education to health and well-being. It is also identified as an area that can strengthen and diversify the development of a night-time economy. This cultural ecosystem adds to the vibrancy of the city all year round and increases the attractiveness of the city as a place to live, work and visit.

There is a need to provide continued tangible support for the development of the creative economy, this includes support for the delivery of infrastructure, innovation hubs, facilitation of events space through the implementation of the Public Realm Strategy and encouragement of additional dedicated cultural and creative opportunities within the planning for regeneration areas.

This food industry in Galway also plays a role in the economy of the city. Of particular interest are the speciality and artisan foods sector and those that are associated with the hospitality sector. The Galway Market at Church Lane, the seasonal Christmas market, occasional neighbourhood farmer markets at other locations including Woodquay and Fishmarket and recent expansion of outdoor dining all expand on the potential for growth and diversity in this sector. These initiatives build on the award to Galway as a European Region of Gastronomy in 2018 and previous Galway Food Festivals in terms of the benefit they can bring to the local economy.

The Plan through policies and objectives support the development of this sector and encourage further development of the expanding food and beverage sector onto regeneration sites and accommodation of outdoor markets and dining through improvements and facilitating investment in the public realm. The Council also supports initiatives by Fáilte Ireland such as food trails to build on the reputation of the city for high quality produce and also for better integration of the gastronomy sector into the night time economy.

|

Policy 6.10 Creative Economy & Gastronomy Sectors |

|

|

|

Part 2: Retail Strategy

6.4 Context

Retail is Ireland’s largest indigenous industry, employing almost 300,000 people and accounting for 23% of the State’s tax revenue[1]. It supports many more jobs throughout the supply chain and unlike many other sectors, retail jobs are evenly spread across every city, town and village in the country and therefore key to contributing to the vibrancy and vitality and prosperity of settlements.

In Galway, the significance of retailing as a contributor to the commercial life of the city is much in evidence as is the essential support it gives to the economic, social and cultural life of the city. It is a key element in maintaining the attractiveness of the city, in particular the city centre and also a benchmark in maintaining the competitiveness of Galway City in relation to other Irish cities. Retailing also contributes to the visitor experience of the city and consequently to the local economy.

The importance of this sector is reflected in national and regional planning policy which seeks to ensure that that existing and new retail accords with proper planning and sustainable principles. The RSES in particular recognises the critical role that the retail sector has in supporting the vibrancy and vitality of the key centres within the region. The RSES acknowledges the current challenges in the sector and includes for policy objectives that can support and grow retailing, including the adoption of the sequential growth approach, encouragement of regeneration and mix of uses, investment in placemaking and provision of links with public transport corridors. The MASP identifies the hierarchy of retail centres and places particular emphasis on protecting and enhancing the city centre. It considers that Galway City, in particular the city centre functions as the most important shopping area within the county. The importance of this sector is further reflected in the RSES objective to support the city as the primary centre identified for growth in the region.

The national guidelines, the Retail Planning Guidelines (2012) takes the approach that a strong and competitive retail sector demands a proactive approach in planning for retail space. This it is considered will promote vitality and viability in the city centre and other retail areas. It will also support choice and competition to the consumer’s benefit and give appropriate direction for expansion in floor space for all types of retailing. In addition, the guidelines require the wider policy context to be taken into account including the settlement hierarchy, smarter travel plans, climate action, architecture and urban design quality.

The Retail Planning Guidelines (2012) also recommend that for certain authorities, the undertaking of a joint retail strategy where broader catchment areas are involved, will benefit an understanding of retail activity and planning sustainably for such demand. Galway City and Galway County Council are designated as authorities that would benefit from a joint approach. This joint assessment is currently scheduled to commence when a clearer perspective on the functioning of the retail sector is available and when it is anticipated a reduction in Covid-19 pandemic restrictions will allow for footfall and shopper surveys. It is anticipated that when completed, the outcome of the analysis and conclusions can be assessed against policies in both plans and any changes required can be incorporated into the respective development plans.

In the interim the Plan has considered the Core Strategy and settlement strategies of both the City and the County Development Plans. It has assumed that the main settlements identified in Draft Galway County Development Plan 2022-28 will have supporting scales and type of services for their size so that unnecessary leakage of spend into the city will be curtailed. It has also considered the levels of retail floor space that has been built since the last plan, extant permissions and current proposals in the planning process for the city.

Retail Trends

The retail sector has been a vital part in the Irish recovery since the global financial crisis more than 10 years ago. It currently generates sales in excess of €30 billion each year, accounting for approximately 12% of Ireland’s Gross Domestic Product (GDP)[2]. However despite this, the value of retail sales remains 13% below pre-economic crash levels. Retail/IBEC attributes this to significant and fundamental disruption in the industry, not only relating to the increase in online sales but to a transformation caused by a combination of increased competition, changing consumer behaviours, increasing customer expectations, accelerating technology innovation and more volatile consumer sentiment. These trends will require retailers to adapt, invest and engage differently to retain existing customers and attract new ones. Shops will have to offer more than a space to display and warehouse their products and will require an increasing focus on creating destination stores supported by attractive public areas that host other uses which add to dwell time and experience.

This evolution of shopping in town centres from a functional activity to an experience for customers broadens the remit of retail planning policies to include for other associated factors and the need to ensure the attraction of place. This requires encouragement for a mix of complementary non-retail uses such as food and beverage offers, culture, recreation, leisure uses and for enhancement of the public realm and enablement of an all year round calendar of events. It also includes linked investment in transport measures that ensure ease of access, especially sustainable modes. Pursuance of residential use delivered through compact growth policies on regeneration sites will also be beneficial for retailing. It has capacity to create new communities with ease of access to shopping thereby expanding the customer base while contributing to both vibrancy and vitality levels of passive surveillance and safety that in turn can contribute to enabling a healthy night-time economy to flourish.

Galway City Retail Trends

The Covid-19 pandemic exacerbated concerns in the retail sector owing to the lengthy closures of non-essential retailers and social distancing requirements for those allowed to remain open. It greatly impacted the level of footfall in the retail centres in the city. This was reflected in the significant reduction in patronage by the resident population coupled by a significant reduction in daytime workers, students and tourists. Despite the relaxation of Covid-19 pandemic restrictions the longer term impact of the pandemic and the acceleration of changes in the sector may not be apparent in shopping patterns for some time to come. The most recent GeoView 2021 Q.2[3] confirms already however that after re-opening, the majority of counties experienced an increase in commercial vacancies. In the city, total retail is recorded in the Geodirectory data as constituting 20.9% of the total commercial units. In 2021 Q.2 the national average level of vacancy rate in commercial properties was recorded to be at 13.6%, while the city recorded a rate of total commercial vacancy of 17.6% for this period.

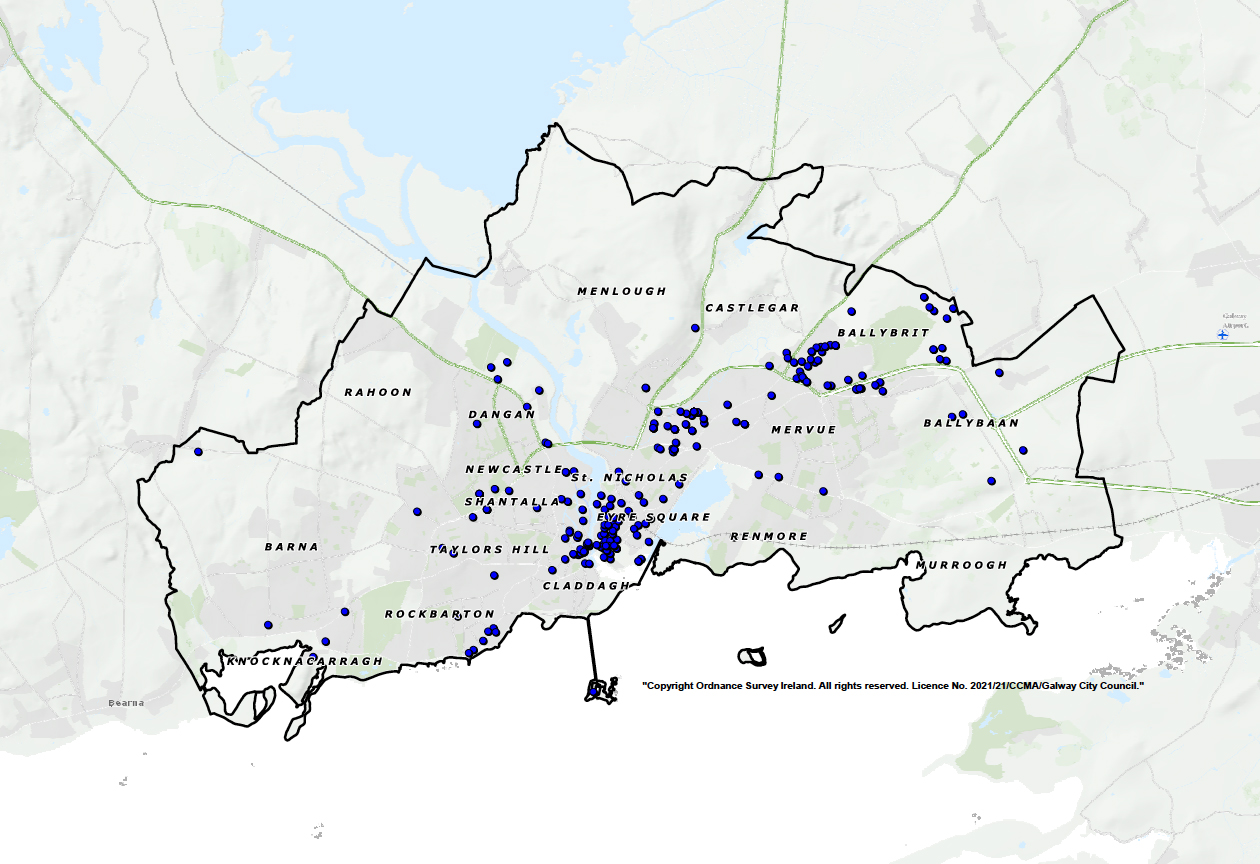

The distribution of retail in the city as recorded in the Geodirectory is shown in figure 6.3. The interval since the adoption of the last Development Plan has seen a large amount of convenience floor space delivered in the city. A review of retail floor space construction up to September 2021 reveals that this is mostly of the discount variety and amounts to an increase of 3,050m2 net floor space distributed mainly in suburban locations. A significant level of comparison floor space 7,482m2 net has also been delivered, mostly concentrated in the city centre and Knocknacarra District Centre, while a change in retailing from comparison to convenience reduced existing net comparison by 1,069m2.

As of September 2021 there are extant permissions for 2,356m2 of convenience floor space and 4,240m2 for comparison. Notable also is the significant quantum of convenience floor space 2,988m2 and comparison floor space 18,442m2 which is included in applications currently in the planning process. The majority of this proposed floor space is located in the Core City Shopping area and awaits decisions from An Bord Pleánala scheduled to be made in Q4 of 2021.

Figure 6.3 Galway City Distribution of Main Concentration of Retail Activity

Source: Geo DirectoryNACE Codes (2020)

6.5 Retail Hierarchy

The RSES and the Galway MASP include support for the continued expansion and enhancement of retail development within the city, acknowledging in particular the significant retail function of the city centre and the catchment it has within the county and region. The MASP supports a retail hierarchy of centres within the city, which is a key requirement of the Retail Planning Guidelines (2012) to give direction on retail policy. In particular this hierarchy will inform the role and importance of the retail centres and it is the basis for determining the appropriate scale and type of retail activity at specific locations. The classification on the retail hierarchy reflects the retail functions of each centre and integrates with and supports the settlement strategy in the Plan. In view of the requirement of the Retail Planning Guidelines (2012) to have a joint strategy for the city and county, the retail hierarchy in Table 6.1 reflects the allocated level on the hierarchy for the settlements within the county as provided for in the settlement strategy and retail hierarchy of the Draft Galway County Council Development Plan 2022-28.

Table 6.1 Galway City and County Retail Hierarchy

|

Hierarchy Level |

Type of Centre

|

Location |

|

Level 1 |

Metropolitan Centre

|

Galway City Centre |

|

Level 2 |

Town Centre

|

Tuam, Athenry, Loughrea, Ballinasloe, Gort |

|

Level 3 |

District Centre |

Doughiska, Knocknacarra, Westside |

|

Level 3

|

District Centre (Planned) |

Ardaun LAP |

|

Level 3 |

Small Town Centres in Metropolitan Area |

Oranmore, Claregalway, Barna. |

|

Level 4 |

Small towns centres outside Metropolitan area |

Clifden, Moycullen, Oughterard. |

|

Level 5 |

Neighbourhood Centre |

Includes Salthill, Renmore Knocknacarra (Shangort), Doughiska (Doughiska Rd.) Road), Roscam; Mervue, Castlegar, Ballinfoile. |

|

Level 5 |

Neighbourhood |

Lower tier village settlements in the county |

|

Level 6 |

Local Shops |

Corner/Local shops the city and county. |

Metropolitan Centre - Galway City Centre

Galway City centre is the principle retail area within the Galway MASP. It has a substantial catchment that extends out to the county and the wider region. The buoyancy of retailing in the city is not only sustained by this catchment but also the strong tourism market, the significant non-resident daytime workforce and the seasonal influx of third level students. This is in evidence in the range of goods and services on offer in the city centre which is sustained all year round and cumulatively contributes to the vibrancy and vitality of the city centre.

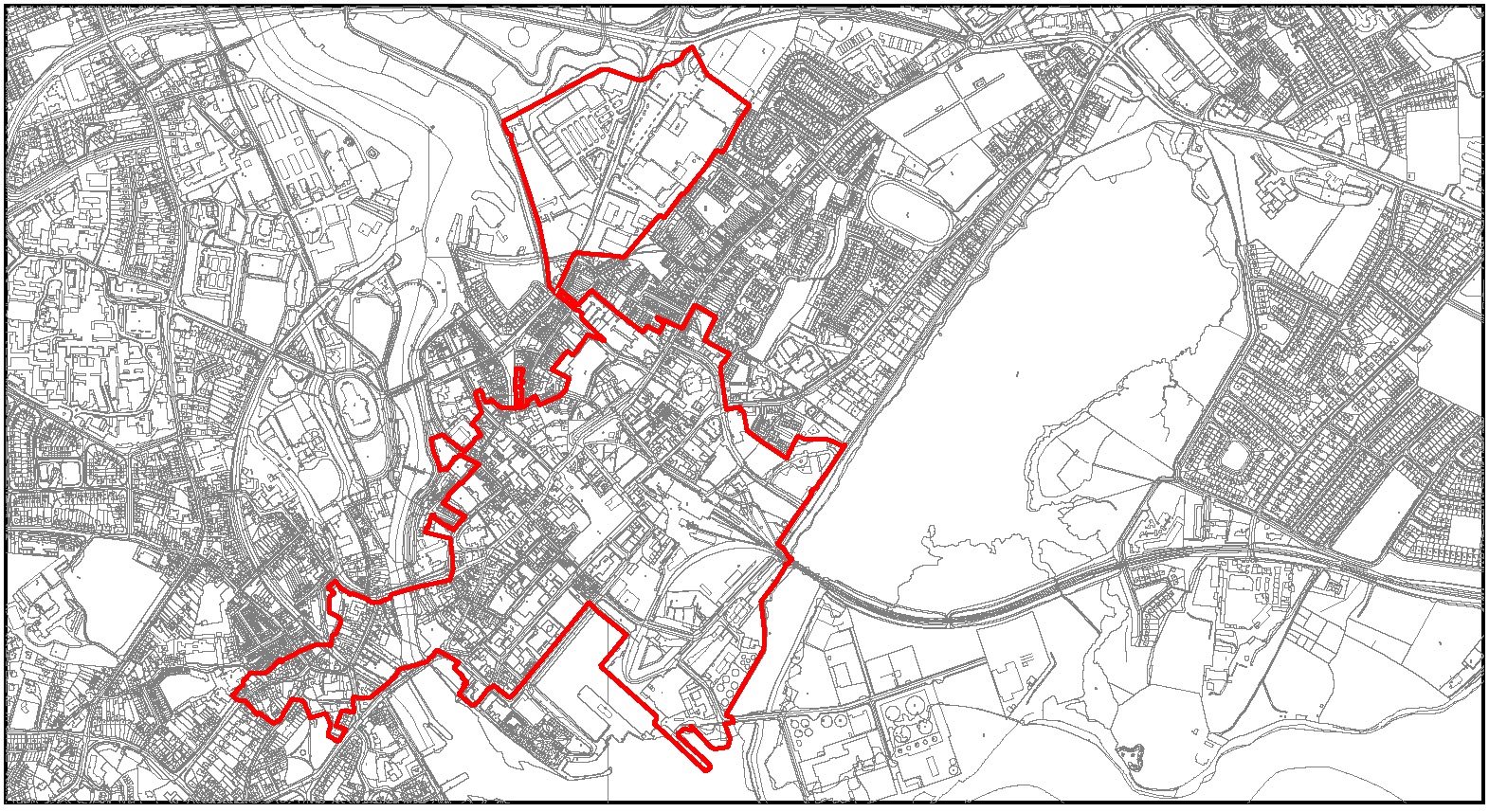

The ‘core shopping area’ is required to be defined for the purposes of the retail strategy in accordance with the Retail Planning Guidelines (2012). This area as shown in Figure 6.4 includes the area zoned specifically for city centre purposes and also includes the commercially zoned and operating area extending to part of the Headford Road, south of the Bodkin junction. These lands include the existing built up area of the city centre, the existing established shopping area at the Headford Road, and a number of substantial brownfield sites that can accommodate the demand for the expansion in retail development in conjunction with the development of other land uses. Within this area there is already a significant amount of high order comparison retailing and specialist services that are not available elsewhere in the County. This attraction and market dominance reflects the current status of the city and the potential of the city to grow to a scale as intended for in the NPF/RSES.

The retail strategy for this plan is to direct major expansion in retail development into the city centre, in particular that of a high order comparison nature and to reinforce the function of the city centre as the hub of public life in Galway. It is considered that the success of expansion of retail services will be strengthened where it is delivered in tandem with, a diversity of uses, new neighbourhoods and an expansion of public spaces arranged in a consolidated and compact format and framed in high quality design.

Figure 6.4 Core Shopping Area

This approach reflects the success of modern retail formats where the development of the sector operates in a broader economic context, with a mix of complementary uses and activities where shoppers have easy access and an experience of a good quality urban environment. Galway City centre has much to offer in this regard with a high quality built and natural environment, a range of other uses, good leisure and recreational opportunities, cultural experiences and an all year round calendar of events. However the city will need to expand and diversify the retail offering to remain competitive, service the ambitious population growth targets, and to provide for the associated employment needs. Appropriately focused planning policies can facilitate this through a plan-led approach and can, as is required under the Retail Planning Guidelines (2012), do this in particular through activating the potential redevelopment opportunities as exist in the city core.

The historic core of the city currently affords few opportunities to meet the demands for large modern floorplates but the adjoining designated regeneration sites at Ceannt Quarter and the Inner Harbour and to a lesser extent the Eyre Square East site can provide a seamless link from the intimate street network of the core onto these larger scaled brownfield sites. These brownfield sites have significant capacity to support a more diverse retail offering in a mixed use context. They have a scale and location that can also support a critical mass of housing and modern office developments. They also have a capacity to create new public realm and expanded civic and cultural spaces. Some of these elements are emerging in schemes that are currently under construction, included in extant permissions and included for in emerging proposals. If delivered these will make a significant contribution to the viability and vitality of the city centre, the competitiveness of the Galway MASP and the creation of new neighbourhoods.

The Headford Road LAP area is an additional designated regeneration site which is located in the defined core shopping area. It currently includes a significant level of comparison and convenience retail floor space, set in expanses of surface car parking. These are mainly accommodated in a 1970’s shopping centre and an adjoining retail park. In form and layout this area lacks cohesion, a sense of place, good linkages and failure to take advantage of the adjacent natural heritage assets, which include the River Corrib and Terryland Forest Park. These areas could benefit greatly from an improved urban structure, modernisation, quality design, a greater mix of uses, better linkage and integration with the finer grained street network in the historic core and a significant upgrade to the public realm.

There has been a number of historical and extant grants of permission for retail floor space which include for elements of this rejuvenation and also include for residential uses in the mix. In addition, recent Land Development Agency (LDA) interest in developing part of these lands for housing, is welcome and has potential to contribute to delivering a new mixed use neighbourhood at this location.